Includes the Your Money Degree App

The missing step most courses skip.

Calculate and track net worth, create a proper budget, compare your debt statistics, tax organization checklist, investment portfolio tools, financial advisor scorecards, rent vs buy calculator, workplace benefits optimizer, insurance needs analyses, create a "death binder", and more!

Don't just calculate your net worth.

SEE your net worth.

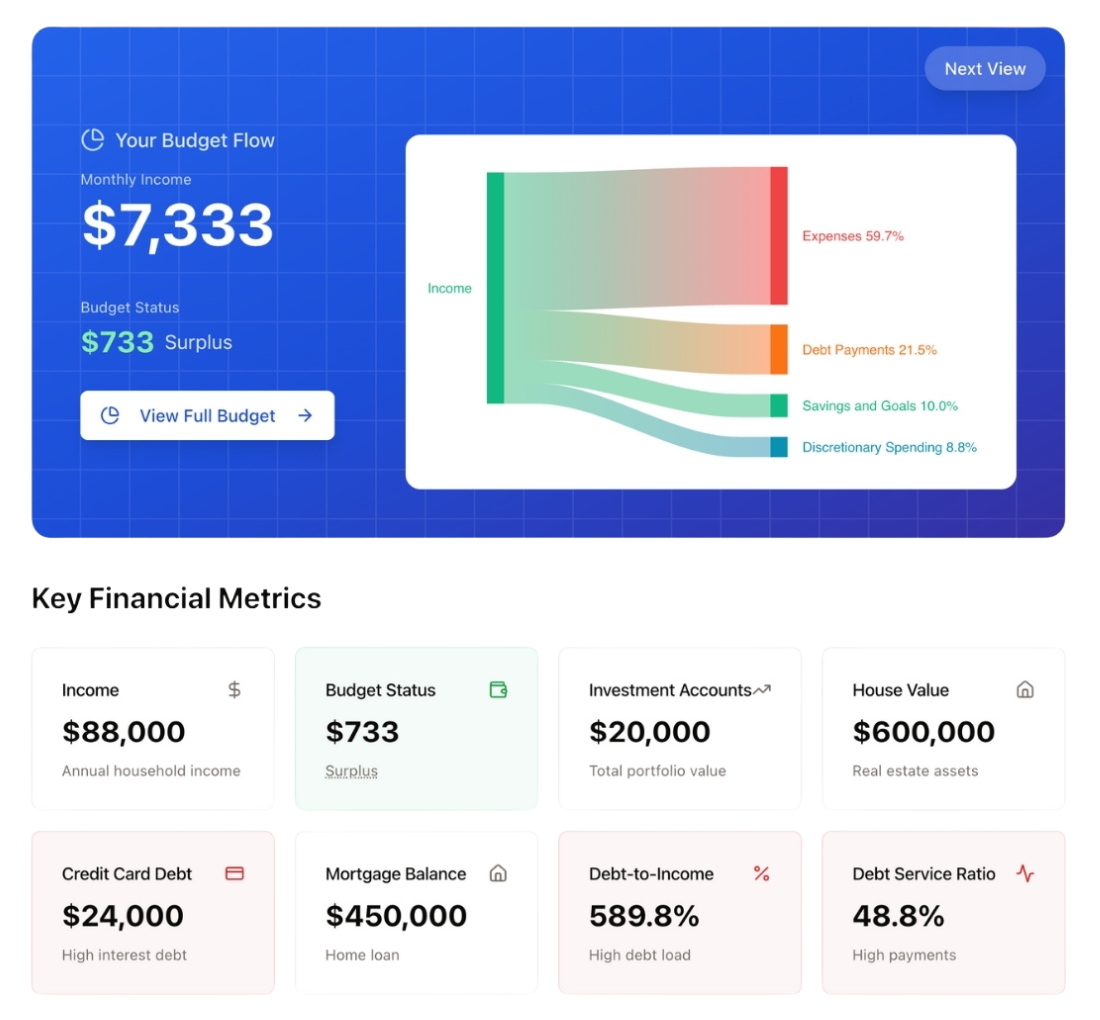

Make sense of your money

Track your income, debt, spending, savings, and progress in a single visual dashboard that shows exactly where you stand and what to do next.

Cheryl Hickey

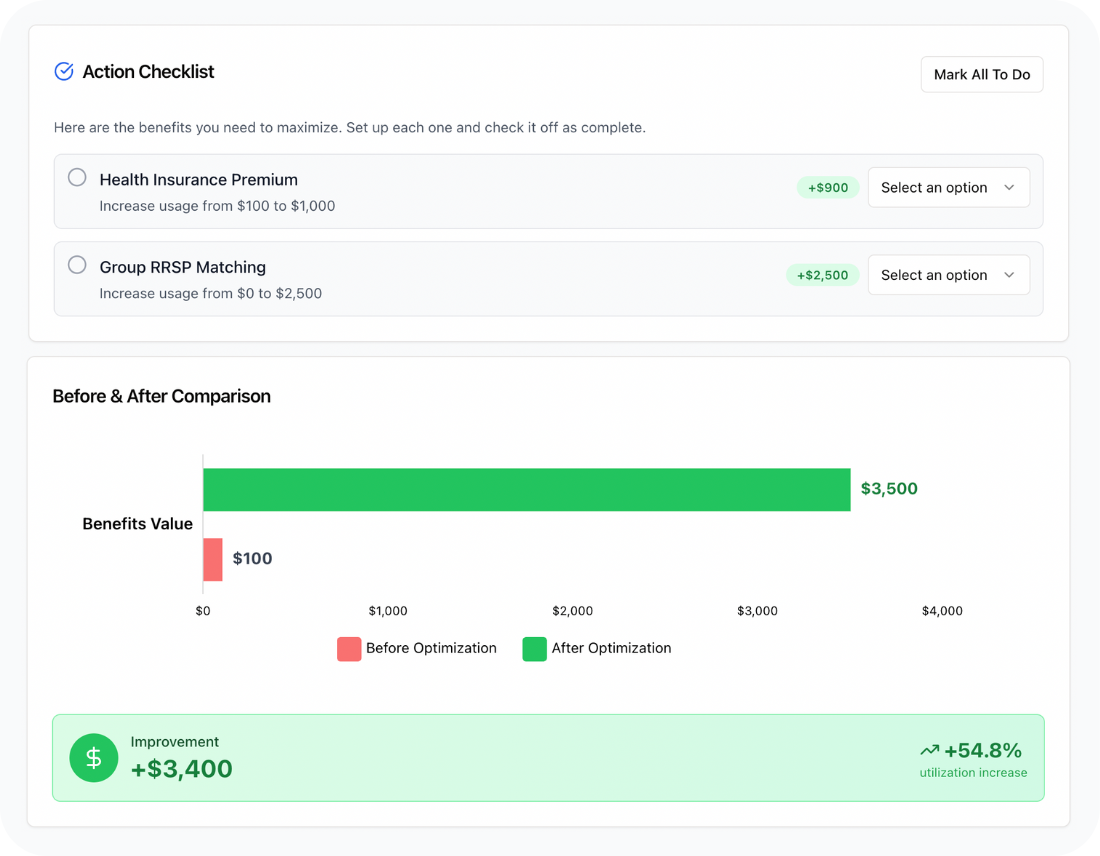

Workplace Benefits Optimizer

Discover and maximize the value of your workplace benefits

Meet Preet

Preet Banerjee

Course curriculum

Everything you should have been taught in school

-

-

1

Introduction

-

2

Growth Mindset

-

3

Understanding your baseline net worth

-

4

Action - Create net worth statement

-

1

-

-

1

Why Budgeting Matters

-

2

Understanding Your Current Spending

-

3

Accounting for Irregular Expenses

-

4

Creating Your Monthly Spending Plan

-

5

Creating your new budget

-

1

-

-

1

Introduction to Debt

-

2

The Debt Mindset - Breaking Free from Financial Shame

-

3

Understanding Different Types of Debt

-

4

Your Credit Score and Why It Matters

-

5

Debt Repayment Strategies That Actually Work

-

1

-

-

1

Introduction to Tax Planning

-

2

Tax Mindset

-

3

Understanding the Canadian Tax System

-

4

Tax Deductions vs Tax Credits

-

5

Income-Tested Benefits

-

6

Tax-Advantaged Accounts

-

7

Understanding Side Income and Self-Employment Taxes

-

8

Action - Create Your Tax Planning Strategy

-

1

-

-

1

Introduction to Investing

-

2

Investment Mindset - Overcoming Fear and Inaction

-

3

Understanding Investment Fundamentals

-

4

Diversification

-

5

Investment Vehicles

-

6

Active vs Passive Investment

-

7

Understanding Your Risk Profile

-

8

Rebalancing a Portfolios Asset Allocation Over Time_

-

9

Tax-Advantaged Investment Accounts

-

10

Building Your First Investment Portfolio

-

11

Action - Create Your Investment Plan

-

1

-

-

1

The Advice Mindset - Overcoming Psychological Barriers

-

2

Financial advice comes in many shapes and sizes

-

3

Understanding the Financial Advice Landscape

-

4

Evaluating Financial Advice - Credentials, Conflicts, and Red Flags

-

1

-

-

1

Introduction to Housing Decisions - Beyond the Investment

-

2

Rent vs. Buy - Seven Questions to Ask Yourself

-

3

The True Cost of Homeownership

-

4

Ongoing Costs of Homeownership

-

5

Mortgages 101 - From Pre-Qualification to Renewal

-

1

-

-

1

Introduction to Total Compensation - Beyond Your Salary

-

2

The Benefits Mindset - From Afterthought to Strategy

-

3

Understanding Your Total Compensation Package

-

4

Insurance Benefits - Protecting Your Financial Future

-

5

Retirement Plans with Employer Match - Free Money for Your Future

-

6

Leaving or Changing Jobs - Protecting Your Benefits

-

1

-

-

1

Introduction to Insurance - Beyond Just Another Expense

-

2

The Insurance Mindset - From Expense to Protection

-

3

Understanding Risk Pooling - The Foundation of Insurance

-

4

Your Existing Safety Nets - Government and Employer Benefits

-

5

Core Personal Insurance - Life, Disability, Critical Illness

-

6

Other General Types of Insurance

-

7

Determining Your Insurance Needs - A Practical Approach

-

8

Final Insurance tips

-

9

Action - Create Your Insurance Protection Plan

-

1

-

-

1

Why Estate Planning Matters

-

2

Mindset and Momentum

-

3

Estate Planning Basics

-

4

The Death Binder

-

1

-

-

1

The Final Steps

-

1

Why Your Money Degree?

Typical App |

Typical Course |

Your Money Degree | |

| Teaches financial literacy | ✖ | ✓ | ✅ |

| Helps you apply it with tools | ✓ | ✖ | ✅ |

| Canadian-specific | Rare | Sometimes | ✅ |

| Calculators and tools | ✓ | ✖ | ✅ |

Your Money Degree

Financial freedom for real life in Canada.

In a world where everything costs more, this course helps Canadians take control of their future and build financial freedom.

FAQ

-

What exactly is Your Money Degree?

Your Money Degree is the only Canadian program that combines a full personal finance course with a companion app that helps you put every lesson into action and learn by doing.

It is comprehensive: teaching you everything from how to create a net worth statement and budget, to learning about investing and managing credit, teaching you about insurance and basic estate planning, and providing you with an accountability system and reminders to help you get on track, and stay on track.

-

Who is this course for?

This course is built for everyday Canadians who want to finally feel in control of their finances, from young professionals just starting out, to families juggling competing priorities, to anyone ready to make confident financial decisions.

-

Do I need any financial background to take this course?

No experience needed AT ALL. Your Money Degree starts with the basics and builds toward more advanced topics with clear, jargon-free explanations every step of the way.

-

How long does it take to complete the course?

There are 62 video lessons totaling just over 4 hours, but you can move at your own pace. Most learners can expect to complete the course and companion app exercises over one month.

-

What makes this course different from other money courses?

Unlike generic online courses, this one is Canadian-specific, visually engaging, and paired with a companion app that helps you actually apply what you learn directly to your real finances. No fluff, just actionable, step-by-step progress.

-

Who teaches the course?

The course is taught by Preet Banerjee, one of Canada’s most trusted voices in personal finance, a sought-after speaker, media personality, and award-winning educator known for making money make sense.

-

What’s included when I purchase the course?

You get lifetime access to all video lessons, a full year of access to the companion app, progress trackers, and ongoing course updates, all included with your one-time purchase.

-

How does the companion app work?

The app is your hands-on financial lab. It guides you through personalized exercises, calculators, and tools that let you apply each lesson to your own numbers, helping you turn knowledge into real financial results.

-

Can I access the course on my phone or tablet?

Yes. The entire video course experience is optimized for both desktop and mobile so you can learn wherever you are. The app is best used on a desktop, laptop, or tablet. Though you can access it on mobile as well if you need to!

-

What kind of results can I expect?

By the end of the course, you’ll have a clear financial roadmap, a working budget, a debt and savings plan, an investment strategy, and a complete picture of your financial life, all built by you for your real life.